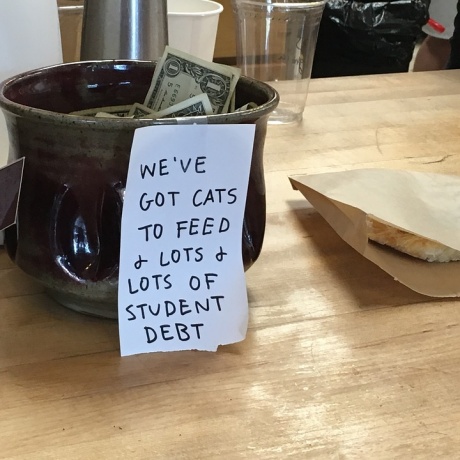

Earlier this year, VCU students surprised many members of the Richmond community when the university was ranked seventh in the country for its number of students seeking sugar daddies. Rising tuition costs are often cited by students registered on...